In a sea of constantly moving variables, navigating the markets (an art and science unto itself) and your financial future ( think taxation, IRA's, life insurance, pensions, other critical insurance, the amount needed for your retirement, estate planning) and the situation can be over-whelming. We cannot see the future, so at best we can imperfectly try to predict it based on historic data and patterns that can often repeat.

In a sea of constantly moving variables, navigating the markets (an art and science unto itself) and your financial future ( think taxation, IRA's, life insurance, pensions, other critical insurance, the amount needed for your retirement, estate planning) and the situation can be over-whelming. We cannot see the future, so at best we can imperfectly try to predict it based on historic data and patterns that can often repeat.

In order to successfully navigate and compute all of the above variables and potential changes so that you can both protect and maximize your financial future, you need an uncommonly clear head which comes from experience, expertise, knowledge and the ability to adapt. It's not unlike any profession. However, when it comes to your finances the wrong decisions can have an irreversible impact on your life and loved one's.

As a former airline pilot many years ago, you qickly learn there is no room for "error". The entire process from take-off to landing requires meticulous attention to detail and any flaws in judgement can have life and death implications. This training has served me well over the 28 years of my financial advisory career. We have a significant ammount of money under management for our clients and this alongside each families complex financial situation and requirements requires precise calculations, ongoing calibration and clear navigation.

...

Moving Averages are simple but powerful indcators for investors as they reflect a prevailing trend in the price of a stock, fund or indices, over the short, mid and long term. They can be used alone or in combination with technical analysis or

Moving Averages are simple but powerful indcators for investors as they reflect a prevailing trend in the price of a stock, fund or indices, over the short, mid and long term. They can be used alone or in combination with technical analysis or  Is the mainstream media a voice you can trust when it comes to helping you manage your wealth? While you may see some good articles on occasion, by and large the mainstream media is there to shock and awe! it's important to remember that the mainstream media's primary objective is to get viewers attention. In order to do that, it needs to utilize copy for headlines that will grab people's attention. It's only business one could say. Sure, but this business can have a significant impact on people's emotions and when it comes to making decisions about matters that impact your finances, emotions can and do play a significant role in peoples decision making.

Is the mainstream media a voice you can trust when it comes to helping you manage your wealth? While you may see some good articles on occasion, by and large the mainstream media is there to shock and awe! it's important to remember that the mainstream media's primary objective is to get viewers attention. In order to do that, it needs to utilize copy for headlines that will grab people's attention. It's only business one could say. Sure, but this business can have a significant impact on people's emotions and when it comes to making decisions about matters that impact your finances, emotions can and do play a significant role in peoples decision making. Beta is a "relative" measure of volatility when measuring a stock or fund against a set market index, in this case the S&P 500. Whether the S&P 500 goes up 1%, 5% or 50% the S&P 500 has a constant Beta value of "1". So, "Beta" is a value assigned to a company based on how it performs over time compared to the S&P 500.

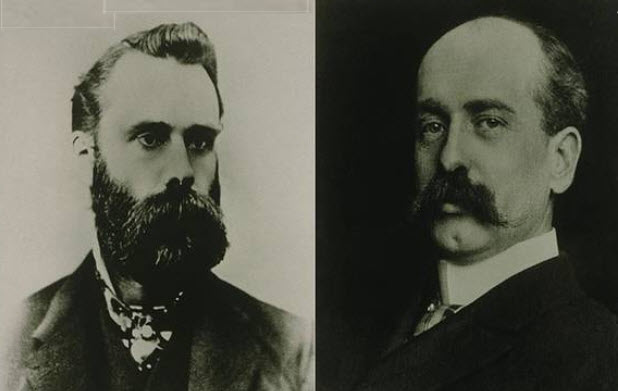

Beta is a "relative" measure of volatility when measuring a stock or fund against a set market index, in this case the S&P 500. Whether the S&P 500 goes up 1%, 5% or 50% the S&P 500 has a constant Beta value of "1". So, "Beta" is a value assigned to a company based on how it performs over time compared to the S&P 500. Dow Theory was first conceived and developed at the end of the 19th Century by Charles Dow, who along with Edward Jones and Charles Bergstresser founded the Dow Jones Industrial Average in 1896. While Dow Theory was developed by Charles Dow, he was unable to complete his ideas around this as he died in 1902. it was later expanded upon by by William Hamilton in the 1920s, Robert Rhea in the 1930s, and E. George Shaefer and Richard Russell in the 1960s.

Dow Theory was first conceived and developed at the end of the 19th Century by Charles Dow, who along with Edward Jones and Charles Bergstresser founded the Dow Jones Industrial Average in 1896. While Dow Theory was developed by Charles Dow, he was unable to complete his ideas around this as he died in 1902. it was later expanded upon by by William Hamilton in the 1920s, Robert Rhea in the 1930s, and E. George Shaefer and Richard Russell in the 1960s.