If you are walking into The French Laundry, a 3 star michelin restaurant in Napa, you may well expect to pay $50 plus for a sandwich extraordinaire. Not so, when you walk into your average sandwich place. I almost fell out of my chair when the person cutting my hair told me she was going to be charged $50 for a chicken sandwich at a local eatery in Walnut Creek, La Fontaine. She had paid $20 for a sandwich one day, $30 the next and then a few days later was presented with the $50 price tag. She declined the sandwich.

If you are walking into The French Laundry, a 3 star michelin restaurant in Napa, you may well expect to pay $50 plus for a sandwich extraordinaire. Not so, when you walk into your average sandwich place. I almost fell out of my chair when the person cutting my hair told me she was going to be charged $50 for a chicken sandwich at a local eatery in Walnut Creek, La Fontaine. She had paid $20 for a sandwich one day, $30 the next and then a few days later was presented with the $50 price tag. She declined the sandwich.

While this may be an extraordinary tale of sandwich inflation and who knows what else, the reality is that the cost of eating out has gone up significantly, but this is sandwich madness. Yes, Russia and Ukraine are two of the largest exporters of wheat and there will be supply shortages that impact prices worldwide. The Russia-Ukraine situation has also sent gas prices soaring. Gas prices have risen to some of the highest in recent USA history. However, has America stopped growing its own wheat and raising it's own chickens? Of course not. So, why is a local sandwich shop in Walnut Creek charging $50 for a chicken sandwich? Is it the best chicken sandwich in Walnut Creek? Probably not.

The supply chain issues have given opportunity for corporate and business greed to inflate as well. While some price increases may be justified, of course, some price increases across a range of industries ranging from 50-500% are quite litterally "out of this world" and unjustified by any rational commercial standards.

...

Authoritarian leaders have many things in common: A need for self-glorification, self-preservation, vanity and power are four of many. They can never get enough of these. One person dictates the future of millions held captive by fear and repression and effects millions in the Ukraine by what ammounts to an open decleration of war. On the one hand, Putin's agenda appears to be founded in reclaiming a long gone era of Russian influence and power and countering his fear of NATO expansion to Russia's borders. While this is no doubt influencing his decisions and causing mayhem with his fragile ego, one can also infer that what is motivating Putin - under the guise of a strongman - is fear for his own political surivival and his legacy with the West encroaching on his doorstep, a Russia that has been broken up and is only a part of it's former empire.

Authoritarian leaders have many things in common: A need for self-glorification, self-preservation, vanity and power are four of many. They can never get enough of these. One person dictates the future of millions held captive by fear and repression and effects millions in the Ukraine by what ammounts to an open decleration of war. On the one hand, Putin's agenda appears to be founded in reclaiming a long gone era of Russian influence and power and countering his fear of NATO expansion to Russia's borders. While this is no doubt influencing his decisions and causing mayhem with his fragile ego, one can also infer that what is motivating Putin - under the guise of a strongman - is fear for his own political surivival and his legacy with the West encroaching on his doorstep, a Russia that has been broken up and is only a part of it's former empire. Are higher interest rates the harbinger of gloom for stocks? That is what the market news headlines are wanting everyone to believe. Well, how true is it though? Yes, interest rates have been at historic lows and this fuelled high growth stocks in 2021 to historically high valuations. The Fed's "temporary inflation" outlook proved less transitory and more embedded in the economy and so the time had arrived to deal with this using the two tools at the Fed's disposal: raising interest rates and tapering or reducing its purchase of central bank assets, essentially a reversal of its quantitative easing policies and removing liquidity from the markets.

Are higher interest rates the harbinger of gloom for stocks? That is what the market news headlines are wanting everyone to believe. Well, how true is it though? Yes, interest rates have been at historic lows and this fuelled high growth stocks in 2021 to historically high valuations. The Fed's "temporary inflation" outlook proved less transitory and more embedded in the economy and so the time had arrived to deal with this using the two tools at the Fed's disposal: raising interest rates and tapering or reducing its purchase of central bank assets, essentially a reversal of its quantitative easing policies and removing liquidity from the markets. We first want to wish all our readers and clients a Happy New Year!

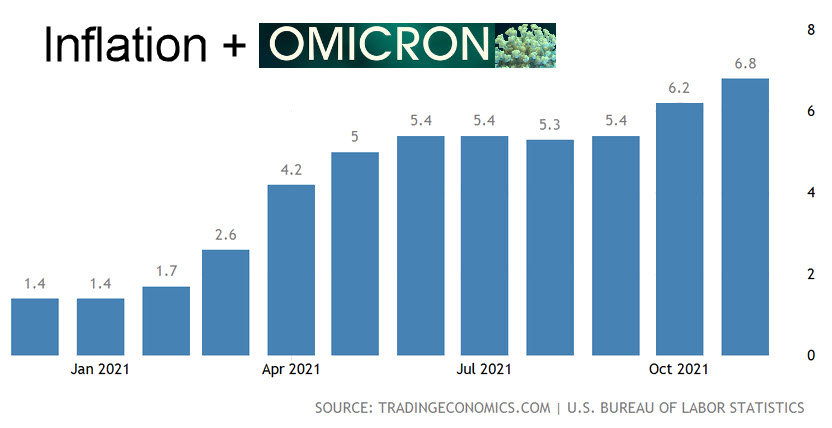

We first want to wish all our readers and clients a Happy New Year! Omicron and Inflation are the boogeymen out to spoil the Holiday Season. Should you let them?

Omicron and Inflation are the boogeymen out to spoil the Holiday Season. Should you let them?