Moving Averages are simple but powerful indcators for investors as they reflect a prevailing trend in the price of a stock, fund or indices, over the short, mid and long term. They can be used alone or in combination with technical analysis or Dow Theory, for example, to chart both primary trends and secondary counter cyclical trends.

Moving Averages are simple but powerful indcators for investors as they reflect a prevailing trend in the price of a stock, fund or indices, over the short, mid and long term. They can be used alone or in combination with technical analysis or Dow Theory, for example, to chart both primary trends and secondary counter cyclical trends.

There are two principal moving averages used by investors:

1. A Simple Moving Average is a historic weighted average price indicator for a stock, fund or market indices. The objective is to provide an average weighted indicator of the stock price that evens out daily or weekly fluctuations in price. A simple moving average takes the artihmetic "mean" of historic prices over a set period of time whether that is 9, 15, 20, 50, 100 or 200 or more days in the past.

...

Is the mainstream media a voice you can trust when it comes to helping you manage your wealth? While you may see some good articles on occasion, by and large the mainstream media is there to shock and awe! it's important to remember that the mainstream media's primary objective is to get viewers attention. In order to do that, it needs to utilize copy for headlines that will grab people's attention. It's only business one could say. Sure, but this business can have a significant impact on people's emotions and when it comes to making decisions about matters that impact your finances, emotions can and do play a significant role in peoples decision making.

Is the mainstream media a voice you can trust when it comes to helping you manage your wealth? While you may see some good articles on occasion, by and large the mainstream media is there to shock and awe! it's important to remember that the mainstream media's primary objective is to get viewers attention. In order to do that, it needs to utilize copy for headlines that will grab people's attention. It's only business one could say. Sure, but this business can have a significant impact on people's emotions and when it comes to making decisions about matters that impact your finances, emotions can and do play a significant role in peoples decision making. Beta is a "relative" measure of volatility when measuring a stock or fund against a set market index, in this case the S&P 500. Whether the S&P 500 goes up 1%, 5% or 50% the S&P 500 has a constant Beta value of "1". So, "Beta" is a value assigned to a company based on how it performs over time compared to the S&P 500.

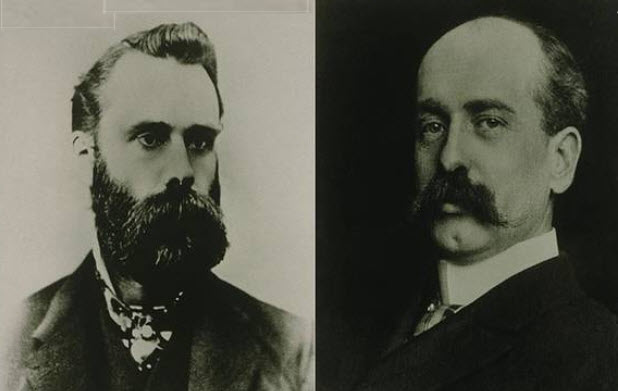

Beta is a "relative" measure of volatility when measuring a stock or fund against a set market index, in this case the S&P 500. Whether the S&P 500 goes up 1%, 5% or 50% the S&P 500 has a constant Beta value of "1". So, "Beta" is a value assigned to a company based on how it performs over time compared to the S&P 500. Dow Theory was first conceived and developed at the end of the 19th Century by Charles Dow, who along with Edward Jones and Charles Bergstresser founded the Dow Jones Industrial Average in 1896. While Dow Theory was developed by Charles Dow, he was unable to complete his ideas around this as he died in 1902. it was later expanded upon by by William Hamilton in the 1920s, Robert Rhea in the 1930s, and E. George Shaefer and Richard Russell in the 1960s.

Dow Theory was first conceived and developed at the end of the 19th Century by Charles Dow, who along with Edward Jones and Charles Bergstresser founded the Dow Jones Industrial Average in 1896. While Dow Theory was developed by Charles Dow, he was unable to complete his ideas around this as he died in 1902. it was later expanded upon by by William Hamilton in the 1920s, Robert Rhea in the 1930s, and E. George Shaefer and Richard Russell in the 1960s. With so much talk in the news of day traders and investors, we thought it would be useful to discuss whether the allure and excitement of short term trading outweighs the more boring strategy of long term investing. On the surface, day trading or short term trading appears to be a relatively easy way to make money. With Tesla and Apple and other tech stocks posting such enormous gains in a relatively short time frame, what is so complicated about doing that?

With so much talk in the news of day traders and investors, we thought it would be useful to discuss whether the allure and excitement of short term trading outweighs the more boring strategy of long term investing. On the surface, day trading or short term trading appears to be a relatively easy way to make money. With Tesla and Apple and other tech stocks posting such enormous gains in a relatively short time frame, what is so complicated about doing that?