The Fed monetary policy is changing, focused now on the "broad based and inclusive goal of full employment". The long held belief that low unemployment was a signal for potential inflation turned out to be a "false" belief. Prior to COVID-19 when the USA apprached its lowest level of unemployment in 50 years economists were surprised to see that there was little to no spike in inflation. The measure(s) of inflation however are complex and an entire paper can be written on the obfuscation of the truth hidden in over 15 different measures of the money supply and how increases in rent, food, health and education expenses are factored into the measure of inflation. We will also not dwell on the fact that trillions of dollars in newly minted currency has entered the economy via the stimulus bills and Fed underpinning of the economy.

The Fed monetary policy is changing, focused now on the "broad based and inclusive goal of full employment". The long held belief that low unemployment was a signal for potential inflation turned out to be a "false" belief. Prior to COVID-19 when the USA apprached its lowest level of unemployment in 50 years economists were surprised to see that there was little to no spike in inflation. The measure(s) of inflation however are complex and an entire paper can be written on the obfuscation of the truth hidden in over 15 different measures of the money supply and how increases in rent, food, health and education expenses are factored into the measure of inflation. We will also not dwell on the fact that trillions of dollars in newly minted currency has entered the economy via the stimulus bills and Fed underpinning of the economy.

For the purposes of this post, we will take the Fed at its word that inflation has been held to less than 2%. That goal however is now going to be sacrificed for the sake of stimulating the economy, job creation and the goal of full unemployment. Forecasts, at this point in time, do not see unemployment falling to less than 5% until the end of 2023. The damage to business and the conomy caused by the coronavirus is going to take time to rectify. The big winners resulting from COVID-19 are the tech businesses that have seen trillions of dollars added to their market cap in less than 6-9 months. It is worth pointing out that ten years ago tech may have represented approximately 16% of the S&P 500 whereas today it comprises almost 37%. That is an enormous shift. At some point "tech" stocks will inevitably correct and with it the S&P 500 to a greater degree given the heavier tech weighting it now bears.

In practice this new Fed policy shift means that they will not consider raising interest rates unless inflation rises above 2% and even then, may continue to keep interests rates low for the purposes of encouraging business investment and a stronger labor market. While this will inevitably mean higher food prices, new asset bubbles forming and who knows what else, the goal of full employment is worth the cost, at least that it is the new theory or belief. This new belief also assumes that if individuals and businesses believe that inflation is inevitable and will result in a dilution of their future dollar spending power, they will be incentivized to borrow, spend and invest their money sooner, leading to a virtuous cycle of stimulating the economy, job creation and rising markets.

...

The COVID induced recession has had a severe impact on the economy with the poorer segments of the population bearing the brunt of the impact. Millions have lost jobs or seen their income significantly reduced. While the Government stepped up with over $3 Trillion in stimulus and support to small and large businesses, extending and supplementing unemployment benefits, the supplemental benefits ended last month. States have also stepped up asking utility companies to put a morotorium on payments for those who have lost their jobs. These morotorium's are also expiring in many states.

The COVID induced recession has had a severe impact on the economy with the poorer segments of the population bearing the brunt of the impact. Millions have lost jobs or seen their income significantly reduced. While the Government stepped up with over $3 Trillion in stimulus and support to small and large businesses, extending and supplementing unemployment benefits, the supplemental benefits ended last month. States have also stepped up asking utility companies to put a morotorium on payments for those who have lost their jobs. These morotorium's are also expiring in many states.

As we head into another election cycle, can history provide is with any clues about how the market or rather the institutional money behaves?

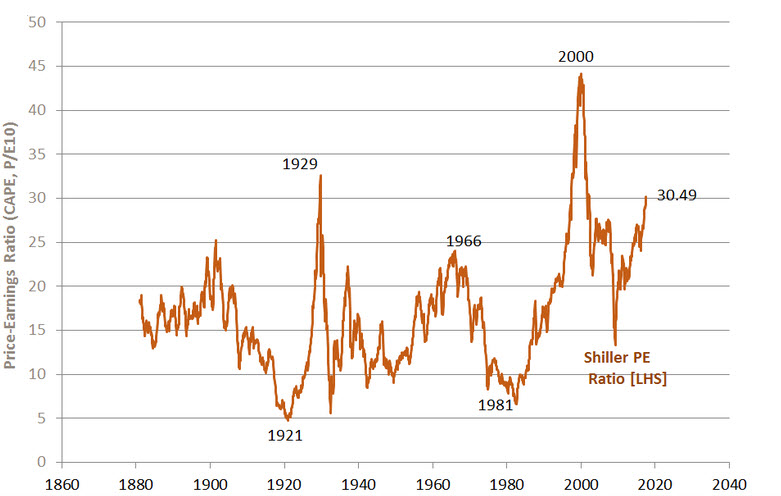

As we head into another election cycle, can history provide is with any clues about how the market or rather the institutional money behaves? Valuation models such as the Price/Earnings (P/E) Ratio or adjusted versions of the latter such as the Shiller

Valuation models such as the Price/Earnings (P/E) Ratio or adjusted versions of the latter such as the Shiller  As investors for the long term, market cycles are an inveitable part of the capitalist boom (expansionary monetary environment) and bust (contraction of credit) cycles that ebb and flow with the economy. Bull and Bear markets are a constant. History proves out for the last hundred years that the overall market trajectory is up, so if you are investing for the long term you dont have to worry providing you are not relying on the market for a significant part of your monthly income. For long term investors who dont need to draw down on their portfolios for income purposes, the psychology to adopt is: "ignore market downturns" and "continue to live your life." The markets will come back. The last hundred years proves they always do!

As investors for the long term, market cycles are an inveitable part of the capitalist boom (expansionary monetary environment) and bust (contraction of credit) cycles that ebb and flow with the economy. Bull and Bear markets are a constant. History proves out for the last hundred years that the overall market trajectory is up, so if you are investing for the long term you dont have to worry providing you are not relying on the market for a significant part of your monthly income. For long term investors who dont need to draw down on their portfolios for income purposes, the psychology to adopt is: "ignore market downturns" and "continue to live your life." The markets will come back. The last hundred years proves they always do! The Fed monetary policy is changing, focused now on the "broad based and inclusive goal of full employment". The long held belief that low unemployment was a signal for potential inflation turned out to be a "false" belief. Prior to COVID-19 when the USA apprached its lowest level of unemployment in 50 years economists were surprised to see that there was little to no spike in inflation. The measure(s) of inflation however are complex and an entire paper can be written on the obfuscation of the truth hidden in over 15 different measures of the money supply and how increases in rent, food, health and education expenses are factored into the measure of inflation. We will also not dwell on the fact that trillions of dollars in newly minted currency has entered the economy via the stimulus bills and Fed underpinning of the economy.

The Fed monetary policy is changing, focused now on the "broad based and inclusive goal of full employment". The long held belief that low unemployment was a signal for potential inflation turned out to be a "false" belief. Prior to COVID-19 when the USA apprached its lowest level of unemployment in 50 years economists were surprised to see that there was little to no spike in inflation. The measure(s) of inflation however are complex and an entire paper can be written on the obfuscation of the truth hidden in over 15 different measures of the money supply and how increases in rent, food, health and education expenses are factored into the measure of inflation. We will also not dwell on the fact that trillions of dollars in newly minted currency has entered the economy via the stimulus bills and Fed underpinning of the economy.