Institutional adoption of digital currencies and payment methods is on the rise. We are seeing a tectonic shift in the payments landscape along with the rise of Bitcoin. However, behind Bitcoin, blockchain companies and projects are looking to reinvent the way individuals and entire industries transact across the entire global industrial landscape.

Institutional adoption of digital currencies and payment methods is on the rise. We are seeing a tectonic shift in the payments landscape along with the rise of Bitcoin. However, behind Bitcoin, blockchain companies and projects are looking to reinvent the way individuals and entire industries transact across the entire global industrial landscape.

One of the the core concepts behind blockchain is "trustless" transactions which essentially means transactions between two parties that are controlled by a piece of computer code "A smart contract" that is programmed to embody the transactional details and execute automatically. Essentially any "exchange" of property or digital property can be programmed accordingly removing the need or reliance on centralized parties or intermediaries to broker an exchange for fees. The movement to decentralised finance for example aims to remove "banks" and "brokers" as intermediaries allowing what is known as "peer" to "peer" transactions. Individual A can buy a stock or any asset directly from Individual B in a secure and trustless manner or Individuals can send monies "peer to peer" directly to one another without a bank as an intermediary.

Every transaction on the blockchain is recorded in a tamper proof ledger. No one can go back in time and modify the ledger which makes blockchain one of the most secure and transparent technologies in history to date.

...

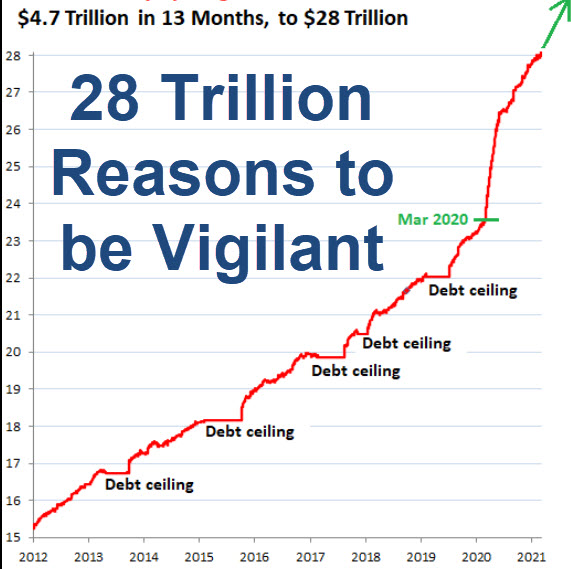

$28 Trillion - take a moment to reflect on this number - is the current total of the US National Debt. As of June 17th it is precisely

$28 Trillion - take a moment to reflect on this number - is the current total of the US National Debt. As of June 17th it is precisely  We have seen this movie before. After the roaring 1920's, the stock market melted up to euphoric highs only to crash in stupendous fashion. In the internet boom of the late 1990's the NASDAQ hit likewise euphoric highs only to crash back down to earth. Following extremely lax lending practices coupled with low interest rates the flying real estate boom coupled with mortgage backed securities fueled the 2007/8 great recession taking the entire banking and monetary system to the brink. Massive stimulus injections lifted us out of that great depression.

We have seen this movie before. After the roaring 1920's, the stock market melted up to euphoric highs only to crash in stupendous fashion. In the internet boom of the late 1990's the NASDAQ hit likewise euphoric highs only to crash back down to earth. Following extremely lax lending practices coupled with low interest rates the flying real estate boom coupled with mortgage backed securities fueled the 2007/8 great recession taking the entire banking and monetary system to the brink. Massive stimulus injections lifted us out of that great depression. The exponential rise in the national debt since COVID began by the tune of more than $3.8 Trillion of stimulus monies was inevitably going to lead to a wave of hard asset inflation as well as consumer inflation. The only question was "how much"?

The exponential rise in the national debt since COVID began by the tune of more than $3.8 Trillion of stimulus monies was inevitably going to lead to a wave of hard asset inflation as well as consumer inflation. The only question was "how much"? Joe Biden announced his new trillion dollar infrastructure plan last week and how he intends to fund it, which sent chills through the markets and the $400,000 plus annual income earners. Of course, this should not have come as a surprise. The odds of the Biden Administration not implementing such a key campaign promise was close to zero. What the announcement did do was sound the alarm ammong the top segment of american earners that it was time to take action and evaluate steps to mitigate taxes going forward under the likely scenarios outlined by the president.

Joe Biden announced his new trillion dollar infrastructure plan last week and how he intends to fund it, which sent chills through the markets and the $400,000 plus annual income earners. Of course, this should not have come as a surprise. The odds of the Biden Administration not implementing such a key campaign promise was close to zero. What the announcement did do was sound the alarm ammong the top segment of american earners that it was time to take action and evaluate steps to mitigate taxes going forward under the likely scenarios outlined by the president.