The Biggest Upgrade to the US Financial Payment Rails Since SWIFT

The Biggest Upgrade to the US Financial Payment Rails Since SWIFT

The biggest upgrade to the payment rails of the US financial industry - since the SWIFT system was introduced in 1973 - is going to be unveiled in July 2023. The system known as FED NOW will enable instant payments that take seconds to complete and can occur 24/7, 365 days a year, all with integrated clearing functionality allowing financial institutions to deliver end-to-end instant payment services to their customers. This means the recipient of funds will have immediate availability and access to utilize these funds. To put this in perspective ACH transfers typically take anywhere from one to three business days to complete, domestic wire transfers can take 24+ hours to complete and international wire transfers can take up to a week to complete. Fed Now will not replace the Automated Clearing House Network (ACH) - at least not anytime soon - and is expected to complement ACH services. However, the writing is clearly on the wall as Fed Now grows its track-record, adoption, sophistication, and capacity.

Instant payments are digital payments which have the capacity to be "programmable" and generate rich data. What is rich data? Rich data is the process of compiling data to determine when and where a person is most likely to buy something, as opposed to relying on trend forecasts. Rich Data is used to predict consumer behavior. While this may sound like a godsend to businesses of all types as well as the Federal Reserve and other agencies who rely on financial data for forecasting and decision making, this "potential to invade privacy" will simultaneously cause consumers to sound the "alarm". Who wants their every transaction to be trackable?

...

In this article we are going to discuss the evolution of AI, its origins and development to here and where it may be heading. Many books have been written on the subject, so this is going to be a short but hopefully informative and abbreviated history to here and a peak into the beyond. We will continue to write about the evolution of AI in our blog and bi-monthly newsletter and build upon this article.

In this article we are going to discuss the evolution of AI, its origins and development to here and where it may be heading. Many books have been written on the subject, so this is going to be a short but hopefully informative and abbreviated history to here and a peak into the beyond. We will continue to write about the evolution of AI in our blog and bi-monthly newsletter and build upon this article. Inflation was up 0.5% in January and the CPI was up for 6.4% from the same period last year. Both numbers were higher than expected and have predictably caused the Federal Reserve to reflect and take a more hawkish stance. Shelter, Food and Energy remain the primary culprits boosting inflation numbers, of which shelter represents approximately 50%. While the markets anticipate a decline in shelter costs over the year this has proved stubbornly resilient to date. The next meaningful economic data announcements this month include "retail sales", the "monthly jobs report" and the consumer price index report for February.

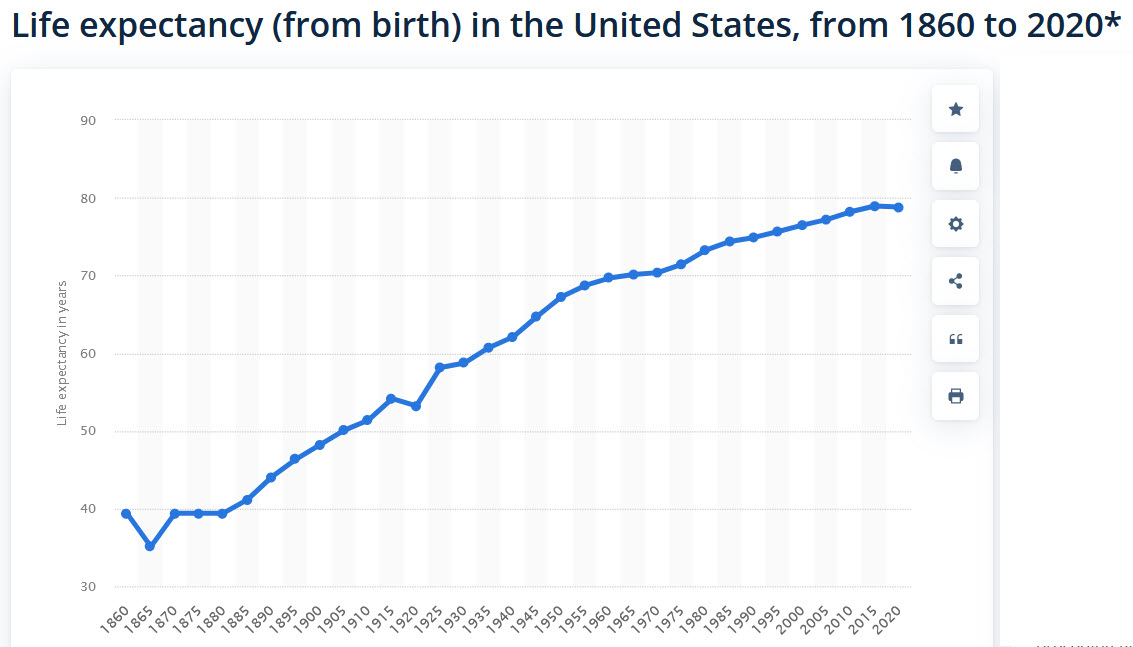

Inflation was up 0.5% in January and the CPI was up for 6.4% from the same period last year. Both numbers were higher than expected and have predictably caused the Federal Reserve to reflect and take a more hawkish stance. Shelter, Food and Energy remain the primary culprits boosting inflation numbers, of which shelter represents approximately 50%. While the markets anticipate a decline in shelter costs over the year this has proved stubbornly resilient to date. The next meaningful economic data announcements this month include "retail sales", the "monthly jobs report" and the consumer price index report for February. Happy New Year! We hope that you enjoyed the festive season and time with family. As we begin another year it is worth reflecting on our good fortune that we are living in an era of remarkable advances in health care that have prolonged the average lifetime. In 1875, the average life expectancy in the USA was 40 years old. By 1960 (85 years later) the average life expectancy in the USA was 69.77years and in 2019, it was 78.79 years. Life expectancy has almost doubled since 1875. It has fallen since 2020 due to the increase in mortality rate resulting from COVID and currently stands at 77.28 years in 2022. Men typically on average have a lesser lifespan reaching approximately 74 years of age whereas women on average live to about 80 years. As medicine advances at an exponential rate with the convergence of quantum computing, biotechnology, genomics, regenerative medicine, research and many other related disciplines, the pace at which healthcare is advancing is accelerating and we can expect the average life expectancy to keep rising alongside these advances.

Happy New Year! We hope that you enjoyed the festive season and time with family. As we begin another year it is worth reflecting on our good fortune that we are living in an era of remarkable advances in health care that have prolonged the average lifetime. In 1875, the average life expectancy in the USA was 40 years old. By 1960 (85 years later) the average life expectancy in the USA was 69.77years and in 2019, it was 78.79 years. Life expectancy has almost doubled since 1875. It has fallen since 2020 due to the increase in mortality rate resulting from COVID and currently stands at 77.28 years in 2022. Men typically on average have a lesser lifespan reaching approximately 74 years of age whereas women on average live to about 80 years. As medicine advances at an exponential rate with the convergence of quantum computing, biotechnology, genomics, regenerative medicine, research and many other related disciplines, the pace at which healthcare is advancing is accelerating and we can expect the average life expectancy to keep rising alongside these advances.