This week's news has been dominated by the crisis in banking and the second biggest banking failure in US history. If one had to point to the root of the current global banking crisis, it would be the "mismanagement of risk", fuelled by a significant dose of depositor and investor fear. This is the common denominator at all the banks that were and still are most impacted.

This week's news has been dominated by the crisis in banking and the second biggest banking failure in US history. If one had to point to the root of the current global banking crisis, it would be the "mismanagement of risk", fuelled by a significant dose of depositor and investor fear. This is the common denominator at all the banks that were and still are most impacted.

Silicon Valley Bank did not adequately hedge it's treasury bond and mortgage backed securities portfolio which had been purchased during the zero interest 2020-2021 environment, leaving it with significant growing unrealized losses as interest rates rose. Under normal banking and economic conditions this would not have been a significant risk. However under significant stress and difficult economic conditions with depositors withdrawing significant funds, the bank could be exposed to having to raise funds to meet withdrawal demands and in order to do that it would have to sell its bonds and mortgage backed securities at a significant loss.

Banks are meant to be in the business of managing risk and mitigating for exactly these types of scenarios. Instead of hedging that risk one must assume that it considered that risk to be an outlier. In either case, one would be right in questioning the judgement of management. As depositors withdrew funds, SVB had to sell its portfolio of bonds and mortgage backed securities for a loss of approximately $1.8bn. When SVB announced this fact to the market - a market that was already on edge - along with the need to raise additional capital, large Silicon Valley VC's began pulling their funds out of the bank which combined with dire messaging amplified through the megaphone of Twitter turned into a stampede. Over $40 billion dollars was withdrawn in 3 days causing the second largest banking failure in US history and new management - that is, the FDIC - to step in.

...

Inflation was up 0.5% in January and the CPI was up for 6.4% from the same period last year. Both numbers were higher than expected and have predictably caused the Federal Reserve to reflect and take a more hawkish stance. Shelter, Food and Energy remain the primary culprits boosting inflation numbers, of which shelter represents approximately 50%. While the markets anticipate a decline in shelter costs over the year this has proved stubbornly resilient to date. The next meaningful economic data announcements this month include "retail sales", the "monthly jobs report" and the consumer price index report for February.

Inflation was up 0.5% in January and the CPI was up for 6.4% from the same period last year. Both numbers were higher than expected and have predictably caused the Federal Reserve to reflect and take a more hawkish stance. Shelter, Food and Energy remain the primary culprits boosting inflation numbers, of which shelter represents approximately 50%. While the markets anticipate a decline in shelter costs over the year this has proved stubbornly resilient to date. The next meaningful economic data announcements this month include "retail sales", the "monthly jobs report" and the consumer price index report for February. In a widely anticipated move Federal Reserve Chairman Powell announced the slowdown in the magnitude of rate hikes to .25%. While the markets were waiting impatiently for a signal that the Federal Reserve will lower rates later in the year, they did not receive this gratification. Chairman Powell is right to be cautious. While early signals do suggest the desired impact of raising rates is leading to disinflation, it is still too early to say for sure. The Federal Reserve's caution and prudence is warranted and a signal to the markets that they are trying to get this right without unnecessarily sending the economy into recession. A wait and see mode makes sense.

In a widely anticipated move Federal Reserve Chairman Powell announced the slowdown in the magnitude of rate hikes to .25%. While the markets were waiting impatiently for a signal that the Federal Reserve will lower rates later in the year, they did not receive this gratification. Chairman Powell is right to be cautious. While early signals do suggest the desired impact of raising rates is leading to disinflation, it is still too early to say for sure. The Federal Reserve's caution and prudence is warranted and a signal to the markets that they are trying to get this right without unnecessarily sending the economy into recession. A wait and see mode makes sense.

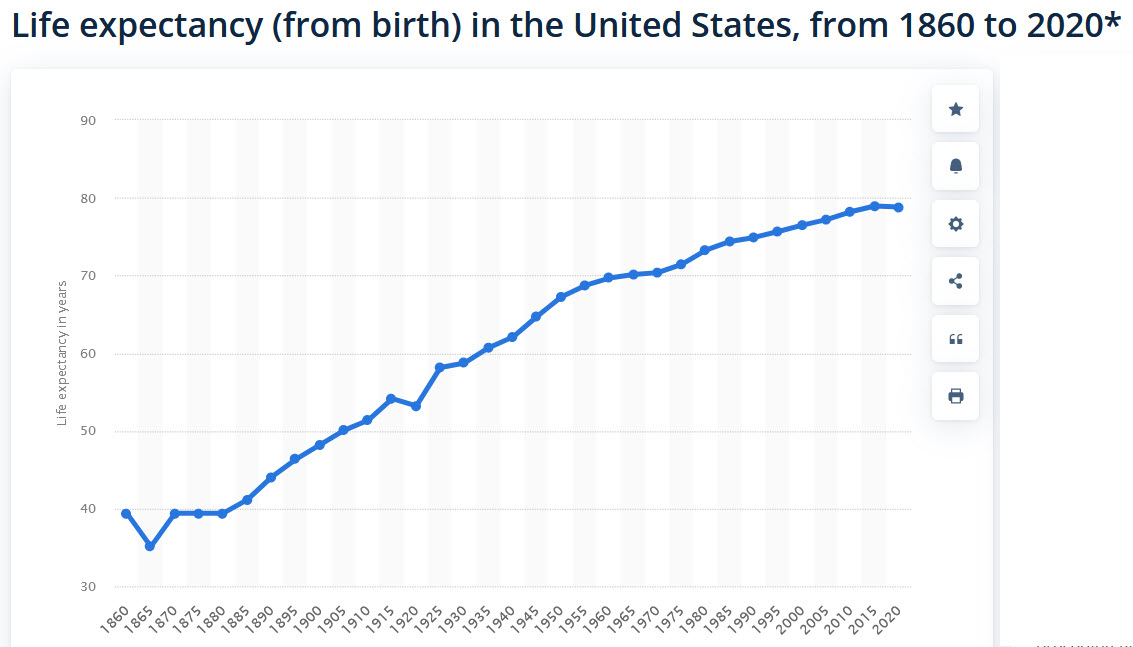

Happy New Year! We hope that you enjoyed the festive season and time with family. As we begin another year it is worth reflecting on our good fortune that we are living in an era of remarkable advances in health care that have prolonged the average lifetime. In 1875, the average life expectancy in the USA was 40 years old. By 1960 (85 years later) the average life expectancy in the USA was 69.77years and in 2019, it was 78.79 years. Life expectancy has almost doubled since 1875. It has fallen since 2020 due to the increase in mortality rate resulting from COVID and currently stands at 77.28 years in 2022. Men typically on average have a lesser lifespan reaching approximately 74 years of age whereas women on average live to about 80 years. As medicine advances at an exponential rate with the convergence of quantum computing, biotechnology, genomics, regenerative medicine, research and many other related disciplines, the pace at which healthcare is advancing is accelerating and we can expect the average life expectancy to keep rising alongside these advances.

Happy New Year! We hope that you enjoyed the festive season and time with family. As we begin another year it is worth reflecting on our good fortune that we are living in an era of remarkable advances in health care that have prolonged the average lifetime. In 1875, the average life expectancy in the USA was 40 years old. By 1960 (85 years later) the average life expectancy in the USA was 69.77years and in 2019, it was 78.79 years. Life expectancy has almost doubled since 1875. It has fallen since 2020 due to the increase in mortality rate resulting from COVID and currently stands at 77.28 years in 2022. Men typically on average have a lesser lifespan reaching approximately 74 years of age whereas women on average live to about 80 years. As medicine advances at an exponential rate with the convergence of quantum computing, biotechnology, genomics, regenerative medicine, research and many other related disciplines, the pace at which healthcare is advancing is accelerating and we can expect the average life expectancy to keep rising alongside these advances.