Are the Roaring 20's Back? Ed Yardeni Thinks They May Be.

Are the Roaring Twenties Back?

Ed Yardeni, former chief investment strategist at Deutsche Bank thinks they may be in a recent interview with Bloomberg senior columnist Merryn Somerset Webb. Ed Yardeni is a well-respected wall street veteran of 40+ years who has served as Chief Investment Strategist of Oak Associates, Prudential Equity Group, and Deutsche Bank. He was also the Chief Economist of C.J. Lawrence, Prudential Securities, and E.F. Hutton.

We made the case for the roaring twenties analogy in an extensive blog article published in 2023, so when we saw Ed Yardeni speaking about the same theme last week, we listened closely. You can watch the whole interview here (approx. 40 mins) or you can read on for the short TLDR summary below in addition to our own thoughts about the coming years, 2024 and 2025.

The 1920’s include similar attributes to the 2020’s. A world war and the Spanish flu pandemic preceded the 1920’s during which a wave of technology and innovation fueled what history labeled as the “roaring 1920’s”. The name was well-earned as it was during this period that the world saw the emergence of groundbreaking innovations that had a global and transformative impact industry and society wide. Broad access to electricity, mass production of the automobile, television, radio, and new phone technology paved the way for a new paradigm in industrial innovation, communications, transportation, and devices unleashing unprecedented productivity increases and by extension, wages and real wealth.

The most dramatic productivity changes were in the manufacturing sector. The introduction of electrically powered machinery to manufacturing resulted in more than 70% of manufacturing running on electricity by the late 1920’s. By 1928, one Model T Ford was coming off the assembly line every 10 seconds. Before World War I, a Ford cost the equivalent of two years' wages for the average worker. By the late 1920s it was about three months' earnings.

In 1907, only 8% of households had electricity. By 1930, 68.2% of all households were electrified which saw corresponding booms in central heating, running water, indoor plumbing, and innovative household devices such as televisions, radios, vacuum cleaners, washers, electric irons, and eventually refrigerators to name a few.

The 2020’s started likewise with a global COVID pandemic and was accompanied by war breaking out in Russia/Ukraine. Today we are seeing technology breakthroughs in AI, Quantum Computing (still in development), blockchain, the Metaverse and their inevitable merger with the entire spectrum of the sciences and industry inclusive of automobiles, robotics, computer storage, processing power, finance, marketing, design, architecture, smart cities and so on which are expected to unleash a new paradigm of exponential innovation and resulting productivity gains. We are sitting on the margins of a quantum leap in technological progress unlike anything we have seen to date at any time in history. That “narrative” which is true and compelling, even though still in its infancy, is a strong one that can fuel a new bull market.

Every bull market has its own “special brand of narrative” or “New Technology of the Time” whether it is the build out of railways, electricity, automobiles, communications, the internet and now, AI. In every epoch of history, the innovative technology of that time promises wonders in human and economic progress and provides the impetus for taking the market higher. Each bull market is accompanied by a select number of companies that fit the “specific narrative of the time” and whom the market expects to benefit the most from said innovations and who are considered the market leaders of their time.

The parallels of the 2020's with the 1920’s are strikingly similar. The invention of electricity and its far-reaching impact on the entirety of global industry and society can be compared to the potential widespread impact that AI, Robotics and Quantum Computing will have on every industry and society at large, over time. The impact and acceleration of change introduced by today’s technological innovations is hard to comprehend. In 1965 Gary Moore, CEO of Intel predicted that the number of transistors on an integrated circuit will double every two years with minimal rise in cost. While this pace of change has slowed in recent years the rate of progress is still astounding and may well accelerate again. AI computing is doubling every 3.5 months, and the full development and impact of Quantum Computing on both AI, Robotics and altogether industry-wide is still yet to emerge. All this is leading to a point in time that technologists refer to as “The Singularity” when the pace of change initiated by peer to peer “technology learning” achieves exponential velocity unlike anything seen before.

And while it will take time for these technologies to mature and their true impact to emerge in the world that we know and experience daily it is the “narrative” and “the promise” of what is “now emerging” and it’s future impact that fuels bull markets which are in turn propelled by a mass of investment capital, available liquidity, rising wages and appreciation in land values. Cue the excitement of recent reviews of Apples new “Vision Pro” headset. The critics and consumer reviews are nothing short of breathtaking. This is just one example of a truly transformative technology, and this is emerging in the context of the significant technological advancements we have referred to in this article. If you add a declining inflationary environment and a shifting Fed stance that is broadcasting future rate cuts in 2024, the essential ingredients for “renewed optimism” are converging, out of which bull markets emerge.

Bull markets are premonitory and exuberant about the future, and are typically ahead of the time to bring these new technologies to maturity and market adoption, and the bubbling exuberance and over-valuation of assets fueled by excess liquidity and optimism in a bull market will eventually burst led by a “bear narrative” and so the cycle of bull and bear markets keeps repeating.

As we have discussed in prior blog articles the seeds for a bull market are being planted in many sectors led by massive government industrial investment to the tune of more than over $470 billion since January 2021 with the following legislation:

a) The Infrastructure Investment and Jobs Act (IIJA) is purposed to restore and upgrade public infrastructure in transportation, clean power generation, water, and broadband.

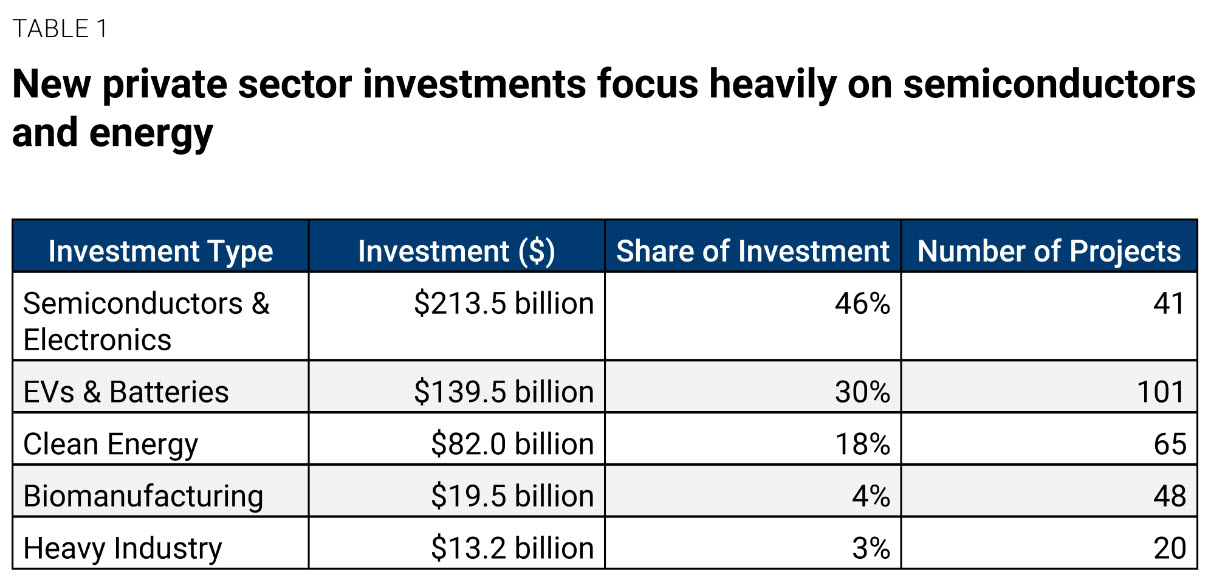

b) The Inflation Reduction Act provides subsidies for clean energy research and development (R&D), production, delivery, and consumption. 48% of new investment announcements are energy-related, with $140 billion in new private capital committed to electric vehicle and battery manufacturing and $82 billion committed to clean energy production. Electric vehicles and batteries account for the largest number of projects (101).

c) The CHIPS and Science Act (CHIPS Act) provides extensive support for R&D and production of advanced semiconductors, which are central to modern economic functioning and have significant security implications. Semiconductors and electronics represent half (46%) of the committed investments, due to the costly nature of fabrication plant construction. Of the ten largest investments announced since 2021, semiconductors account for nine. Semiconductor executives have been among the most vocal in crediting recent legislation—namely, the CHIPS and Science Act of 2022—for influencing their investment decisions.

The combined public and private resources allocated toward this strategy are on a scale that is even larger than the construction of the interstate highway system between 1956 and 1993 which cost $614 billion in 2022 dollars and built a national transportation network. The economic impact of these investments is just as far reaching.

"We believe the U.S. is in the early stages of a manufacturing Supercycle," wrote Joseph P. Quinlan, head of CIO Market Strategy at Merrill and Bank of America Private Bank back in April 2023. As of April 2023, spending on manufacturing construction - new factories - is estimated at a $189 billion annual rate, triple (300%+) the average rate in the 2010’s.

In addition to the widespread US based infrastructure investments…

- Enterprises worldwide, with the US leading the way, have spent around $19.4 billion on generative AI solutions in 2023 according to an estimate from International Data Corp. That spending - which includes generative AI software and related hardware, IT and business services - will reach $151.1 billion by 2027, the research firm forecasts, translating into a compound annual growth rate of 86.1% over the four-year period.

- The global robotics technology market size was estimated at USD 72.17 billion in 2022 and is expected to surpass around USD 283.19 billion by 2032 with a registered CAGR of 14.7% during the forecast period 2023 to 2032.

The combination of public and private investment in turn generates jobs (192,000 just in the construction sector in 2023 for example), economic stimulus, and growth in land values, a significant component that drives economic cycles.

Given this robust investment backdrop it is not surprising that the U.S. economy is stronger than any country in the Group of Seven (G7), with higher growth and cooling inflation over the past three years. This is also thanks in large part to China and Europe experiencing marked economic slowdowns. China’s changing demographic, property and stock market crisis accompanied by weaker consumer spending, high youth unemployment and fleeing foreign capital investment has helped keep prices and demand in check. Europe has likewise stagnated with its leading economic engine, Germany, in crisis. Weakening demand from these two economic powers has contributed to bringing inflation down and provided the US with the strategic opportunity to pave the way forward by investing in shoring up its industrial domestic security, leading R&D in new environmental technologies, and providing the impetus and stimulus for both a recovery and renewed technology led global growth cycle.

- U.S. economic growth accelerated to a red-hot 4.9% annualized rate in Q3 2023.

- The economy added more than 2.5 million jobs in 2023

- Unemployment has remained below 4% for 22 months in a row for the first time since the late 1960s.

- Real wages as measured by the Atlanta Fed wage tracker have risen by 4.5% after inflation - across all job tiers - between 2020 and 2023.

- U.S. inflation is zigzagging lower. CPI moved up to 3.4% year over year in December from 3.1% in November. This was above the estimate of 3.2%

- Core CPI (ex-Food/Energy) moved down to 3.9% YoY, the lowest core inflation reading since August 2021.

In its December FOMC statement, the Federal Reserve forecast three rate cuts this year, even though inflation is still well above the Fed’s 2% target, because it is seeing signs that inflation is slowing. Wall Street has priced in six cuts and while we believe that is unlikely, it points to broad market sentiment and acceptance of a reversal in Fed policy initiated in November 2021 and that rates are heading lower.

Adding to the validity of this narrative is the Fed announcing the closing of the Bank Term Funding Program (BTFP) in March 2024. The BTFP was launched to stem the early 2023 banking crisis that was fueled by rising interest rates, capital leaving banks seeking higher yield and bank sitting on large unrealized treasury bond losses. With the BTFP, the Fed guaranteed to buy back bonds from banks at their full-face value. While many banks made use of the BTFP, banks are still sitting on significant treasury portfolios with unrealized losses. The BTFP has functioned as a confidence back-stop and relieved banks of pressure of speculators shorting their stocks, public uncertainty and fear and potential bank failures that befell Silicon Valley Bank and others. It is unlikely that the Fed wants to see a renewed banking crisis emerge so the Fed narrative of falling rates which will shore up bond prices and provide an anti-dote to another banking crisis where unrealized bond losses are the boogeyman. It may also be why the BTFP is being closed. A resurgence in inflation and rate hike fears would change this narrative but in such an event the Fed can always implement another BTFP.

When asked about potential risks or headwinds to the economy by Merryn Somerset Webb, Yardeni mentions “renewed inflation” due to war and any escalation in global conflicts which could in turn lead to rising energy prices, disruptions in supply and shipping.

History proves that there will be ongoing crises (both expected and unexpected), even amidst a strong economy, and these will - depending on their severity - provide inevitable setbacks and corrections. In a bull market these crises tend to be shrugged off more easily whereas in a bear market they can have a more pronounced impact.

The convergence of ground breaking technological breakthroughs, more favorable fed policy, a deflationary environment, and the emergence of growing global liquidity has all the necessary ingredients for a technology led bull market - with a roaring twenties theme - to emerge.

We hope you find this market commentary helpful. We are committed to keeping our readers and clients informed of what we factually see is happening in the economy at large so they can have a more balanced perspective than the general media tends to portray.

The discipline of Wealth Management takes a long-term view of market and economic trends, demographics, taxation, law, risk management and the unique circumstances and needs of clients. The complexity of managing wealth requires collaboration across several professional disciplines. The cost of employing a wealth advisory firm is nominal compared to the risks and potential losses that one is subject to, both known and unknown, by flying blind to just one or two potential issues or potential points of failure across the ever-changing risk spectrum. It is comparable to the difference between trying to self-diagnose and treat a complex illness and going to a well-known specialist with decades of training in treating such. Which would you prefer?