Valuation models such as the Price/Earnings (P/E) Ratio or adjusted versions of the latter such as the Shiller price-to-earnings ratio (which is a P/E ratio based on average inflation-adjusted earnings from the previous 10 years) aim to project and predict the relative earnings power of a company over a period of 10 years. The higher the PE ratio is, the greater the expectation a company will deliver strong growth and profits. The expectations of strong growth and profits and rewarded by the markets with a higher valuation. Conversely, the lower the P/E Ratio, the lower the expectation of the company's growth rate. This is likewise reflected in the overall valuation of a company. Price/Earnings rate multiples will inevitably decline once a company reaches a certain size which is offset to a degree by the greater earnings realized.

Valuation models such as the Price/Earnings (P/E) Ratio or adjusted versions of the latter such as the Shiller price-to-earnings ratio (which is a P/E ratio based on average inflation-adjusted earnings from the previous 10 years) aim to project and predict the relative earnings power of a company over a period of 10 years. The higher the PE ratio is, the greater the expectation a company will deliver strong growth and profits. The expectations of strong growth and profits and rewarded by the markets with a higher valuation. Conversely, the lower the P/E Ratio, the lower the expectation of the company's growth rate. This is likewise reflected in the overall valuation of a company. Price/Earnings rate multiples will inevitably decline once a company reaches a certain size which is offset to a degree by the greater earnings realized.

Can the P/E ratio help you mitigate risk and optimize returns? It can be a useful factor or variable that should be taken into account along with a number of other variables. For example, it is a useful measure for comparing a company to it's competitors and the aggregate P/E ratio of companies in a particular sector vs another sector of the economy or the market as a whole. Expectations are of course based on human analysis and an unknown outlook of the future. The higher the expectations and resulting valuations, the more risk as a lot needs to go right and keep going "right" in order to justify higher P/E ratios and valuations.

High P/E Ratios can help you identify up and coming companies that the market is identifying as having the strongest potential. Such companies are often referred to as "Momentum" stocks and can deliver significant gains. Companies with strong sales growth provide a foundational underlying metric that offers investors a rational reason for paying a high P/E Ratio for a company. However, this is not always the case. Companies can command high P/E ratios on the promise of high sales and earnings expectations while not yet having any meaningful revenues or earnings. Such companies command even higher risk and warrant expert analysis.

When considering a sector that commands a high P/E Ratio, buying a basket of stocks through a well diversifed ETF or investment fund will reduce your risk exposure. It may also reduce your potential returns but it will give you peace of mind knowing that you are more diversified and that you have a fund that is being overseen by a team with expertise and the resources to evaluate the companies in their portfolio. Not all funds are equal. Looking at the management and composition of the fund as well as any fees, are important factors to consider as well.

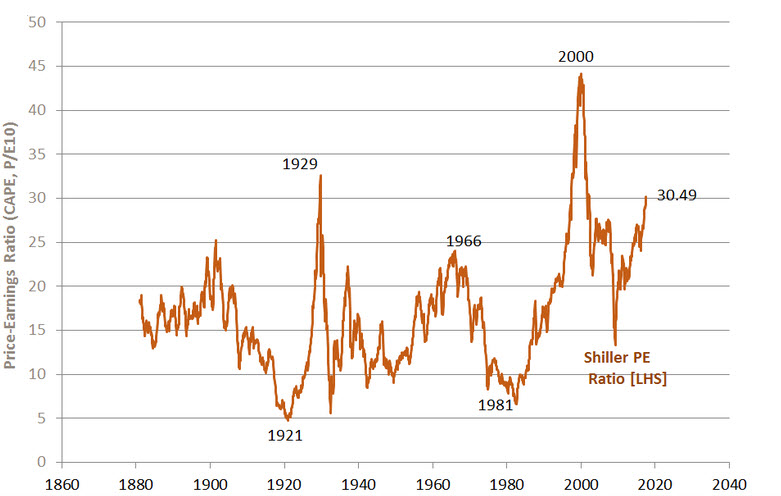

We have considered how P/E ratios should factor into your investment considerations for individual companies. P/E values can also be useful when considering valuations of an entire sector, market or market index. Let's take the Shiller price-to-earnings ratio as an example, which is based on average inflation adjusted earnings from the previous 10 years. In early August 2020, the Shiller P/E index was over 31 for the overall market. It has only been above a P/E ratio of 30 three times since 1900. The first was prior to the great stock market crash of 1929, the second was prior to the year 2000 dot com bubble bursting and the most recent time was in 2018 after the melt-up in equities. It is accurate to state that a "Shiller P/E ratio" over 30 has historically portended a market correction. However, not this time say some analysts who are critical of the Shiller P/E ratio. Critics cite that conditions are different today: we are in a historic low interest rate environment, there is more cash chasing fewer quality companies and that companies are operating in very different global environments than they were ten years ago.

While those critical of the Shiller do point to different factors at play today, the very factors they are pointing to could well be the fuel that creates another series of over-inflated assets.

With the Shiller Index over 30, it should give investors "pause for thought". Should you be playing more "defense" when the Shiller index crosses 30? Should you be looking at your risk-mitigation models and making adjustments? It is entirely possible that the Shiller P/E index could climb higher from here. Do the new "economic" conditions (low interest rates, unlimited fed support and inflation supporting policy) justify it or are they simply "the inevitable fuel" that will compel investors to justify continued investment only for a new and even bigger "asset bubble" to form that will inevitably burst when conditions or minds or both change, leaving investors with the the same conclusion: "this time was no different".

Riding the wave of asset bubbles can of course be highly profitable providing you are aware of them and have risk-mitigating strategies in place.