We have discussed Oscillators as indicators that will depict oversold and overbought conditions over different time periods. Oscillators will vary in what they depict depending on the inputs. In general they will map the trend of a given stocks price movement but depending on the inputs you can amplify the trend or conversely you can soften the overall trend. For short term investors amplifying the trend may provide more accurate short term signals for either entry or exit points and likewise for long term investors reducing the sensitivity of the signal will more accurately depict the long term momentum in price cycles and growth. Longer term investment horizons allow for more underlying data and therefore technical analysis will provide more reliable information for interpretation and analysis than short term investment horizons.

We have discussed Oscillators as indicators that will depict oversold and overbought conditions over different time periods. Oscillators will vary in what they depict depending on the inputs. In general they will map the trend of a given stocks price movement but depending on the inputs you can amplify the trend or conversely you can soften the overall trend. For short term investors amplifying the trend may provide more accurate short term signals for either entry or exit points and likewise for long term investors reducing the sensitivity of the signal will more accurately depict the long term momentum in price cycles and growth. Longer term investment horizons allow for more underlying data and therefore technical analysis will provide more reliable information for interpretation and analysis than short term investment horizons.

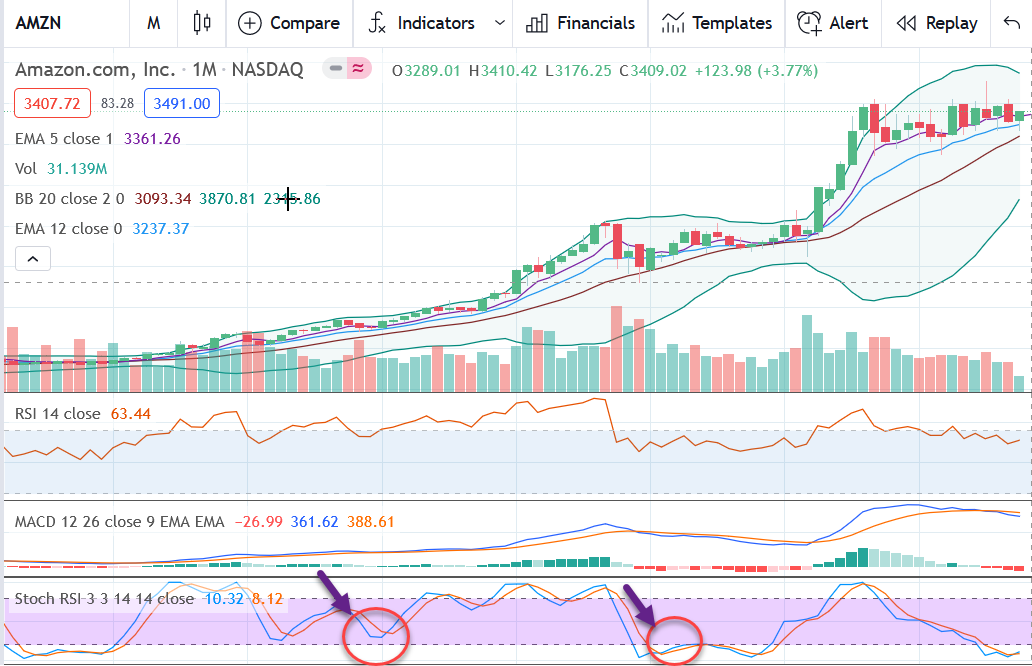

If investors believe in the long term growth prospects of a stock or fund (basket of companies) then buying at those times when price oscillates to the lower bands of the stochastic oscillators numeric ledger, usually 0-20 (which signals oversold conditions) can be on approach to steadily acumulate a position over time. Investors looking to rebalance their portfolios on a stock or fund that has outperformed the market for years may look at a long term oscillator top range, usually above 80 (which signals overbought conditions) as one of many different signals to assess when to exit a portion of their position and re-balance their portfolio. The chart on the right shows Amazon's monthly stock price movements and points to 2 moments in time when the stochastic oscillator was at a low. If you believed in the long term growth prospects of Amazon, both these moments in time would have provided good entry points to accumulate stock.

Technical analysis used in conjunction with macro analysis can provide a more balanced and objective perspective for purposes of portfolio management, entry and exits, investment and rebalancing decisions whether that is for an individual investor or asset manager over different time periods. Technical analysis is a tool which requires context and experience to assess and use. That context is based on the investment goals of an investor or fund manager.