In a perfect world, every money decision we make would be totally rational.

We’d consider all of the facts. Then, we’d balance them with the risks to make the

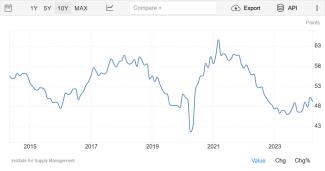

The ISM manufacturing index is a monthly index published (since 1948) at the beginning of the month by the Institute of Supply Management (formerly known as the

Read More

All the math you need in the stock market you get in the fourth grade.

— Peter Lynch

Read More

Ed Yardeni, former chief investment strategist at Deutsche Bank thinks they may be in a recent interview with Bloomberg senior columnist Merryn Somerset Webb

Read More

In this second installment of "What the Hec'onomy. Deciphering what is going on in the economy and markets" we will examine what the impact of rate hikes have

Read More

If you are perplexed trying to understand the health of the economy and the impact of two wars, a growing national debt, inflation, and interest rate policy on

Read More

A “conundrum” is defined by the Collins dictionary as a problem or puzzle which is difficult or impossible to solve.

How do you make authoritarianism

Read More

"Nothing is so treacherous as the obvious" observed Joseph A Schumpeter the famous Austrian political economist who is regarded as one of the 20th century's

The biggest upgrade to the payment rails of the US financial industry - since the SWIFT system was introduced in 1973 - is going to be unveiled in July 2023

Read More

THE THREE INTERESTS SHAPING THE ECONOMY

Self Interest, Government Interest & The Inverted Yield Curve Interest

Read More

In this article we are going to discuss the evolution of AI, its origins and development to here and where it may be heading. Many books have been written on

Read More

LET US PRAY...

"All we can do I think collectively is to pray that everyone in the United States understands how important the sanctity of the sovereign

Read More